r&d tax credit calculation uk

Architecture Construction Engineering Software Tech More. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors.

Inventory Turnover Analysis Templates 13 Free Xlsx Docs Inventory Turnover Financial Statement Analysis Analysis

The business must claim the payroll tax credit election on an originally filed federal income tax return.

. Deduct 80000 in RD expenditures. R. The RD tax credits calculator is a handy tool that will help you find out how much you can potentially claim back from your RD investment.

In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process. Please provide a valid how much have you invested in rd over the last year. Calculate RD tax relief in under 3 minutes.

For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect. Registered in England Wales Company Number 11437826. For a loss-making SME RD tax credits will be given in the.

RD Tax Credits Calculator. The rate at which businesses calculate their RD tax credit depends on. Our RD Tax Credit Calculator answers those questions and gives you an instant estimate of the benefit available to you.

You could receive up to 000 in. The calculator has been specifically developed using historic claim. 80000 x 230 184000.

How to Calculate RD Tax Credit for SMEs. RDvault charges a fixed price for your RD claim from 249 up to a maximum of 1995 for any size claim. This means your revised loss for the year will be 554000.

What is an RD tax credits calculator. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC. Find Out If You Qualify For The RD Tax Credit.

Pilot Helps You Maximize Your Savings While Doing The Heavy Lifting. Data Protection Number ZA453238. It can also be claimed by SMEs and large companies who have been subcontracted to do RD work by a large company.

Ad Aprio performs hundreds of RD Tax Credit studies each year. RDvault charges a fixed price from 749 capped at 1995 for. With a 100 success rate qualified and experienced staff and sector specialists at our disposal we make the process quick and hassle-free.

Ad Our sector specialists can maximise your RD claim. Enter your sub-contracted costs that are directly related to RD projects. The email address in the When you cannot use the online service section has been updated.

In Under 20 Minutes See If You Can Claim A RD Tax Credit With Our Fast Easy Process. Ad Your Business Could Save Up To 250000 Through The RD Tax Credit. Based on the information.

Get the cash injection you deserve with Direct RD and submit your claim today. The RDEC is a tax credit it was 11 of your. Home RD Tax Credits Calculator.

Maximise your R. Architecture Construction Engineering Software Tech More. If you dont have all.

Ad Aprio performs hundreds of RD Tax Credit studies each year. On this page you can calculate the value of your Research Development tax credits claim. This can include freelance sub-contractors that are actively involved in development activities as well as agency.

If you spend money creating or improving products or services. Call today for your free review. Heres your RD Report.

Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Ad Our sector specialists can maximise your RD claim. If you spend 200000 on RD you can knock just under 50000 off your Corporation tax bill for that year.

Call 01332 819 740. The RD tax credit scheme is a UK government scheme that is aimed at rewarding and incentivising innovation in the private sector. Call today for your free review.

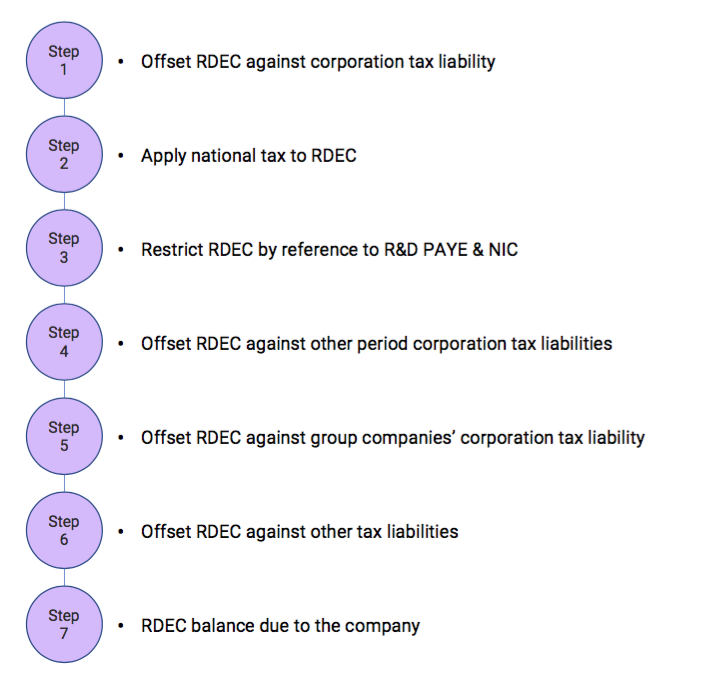

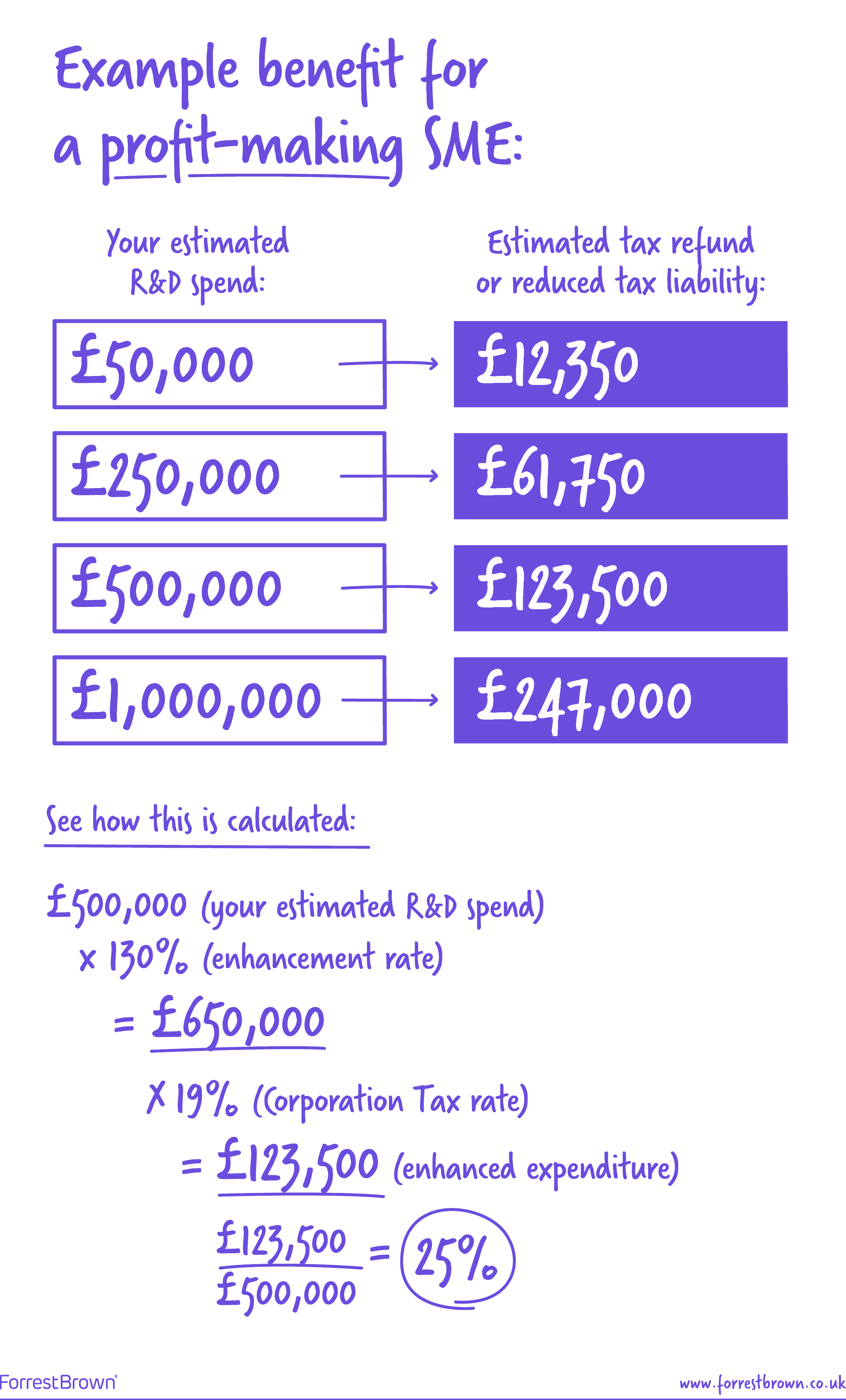

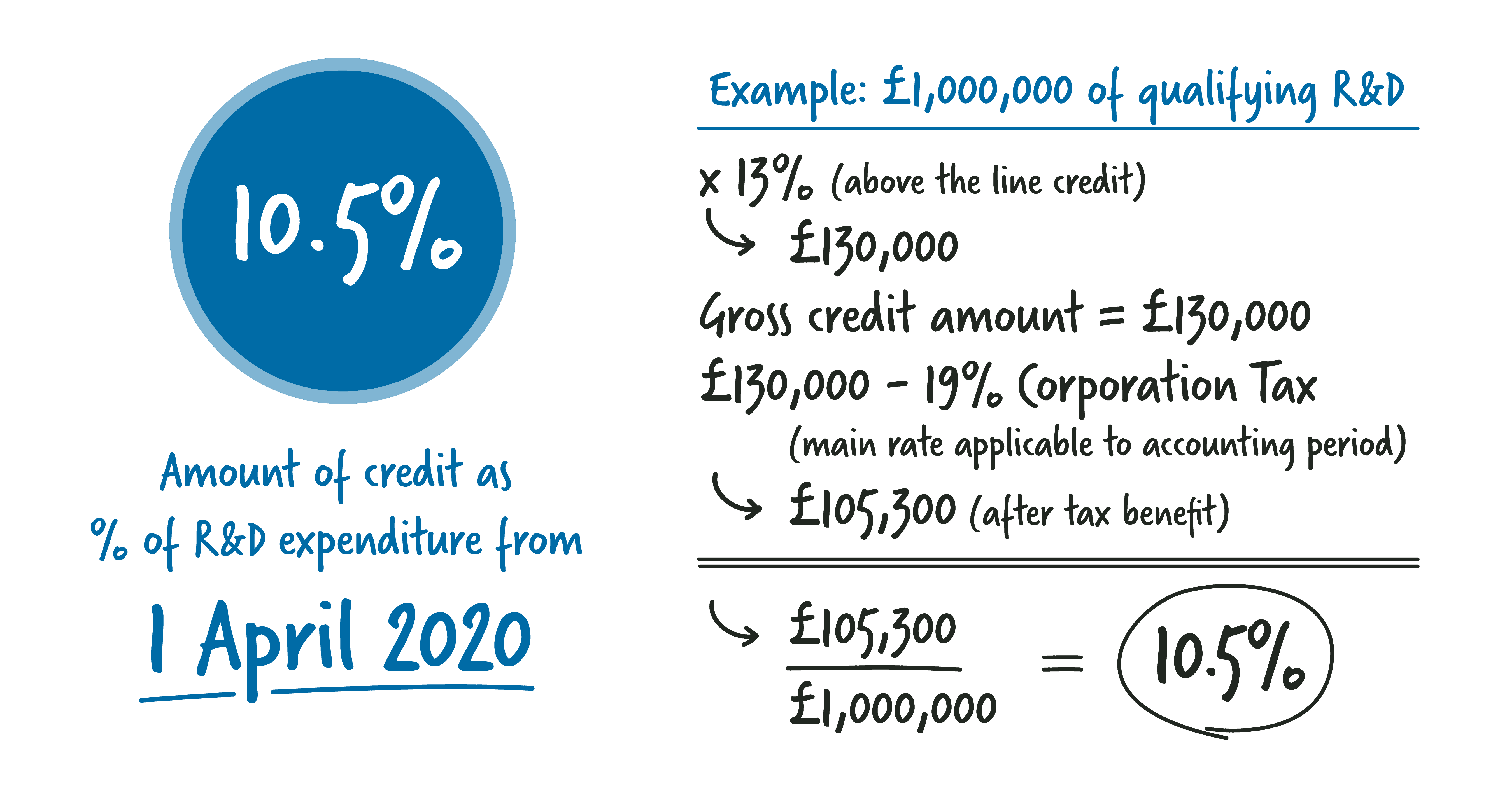

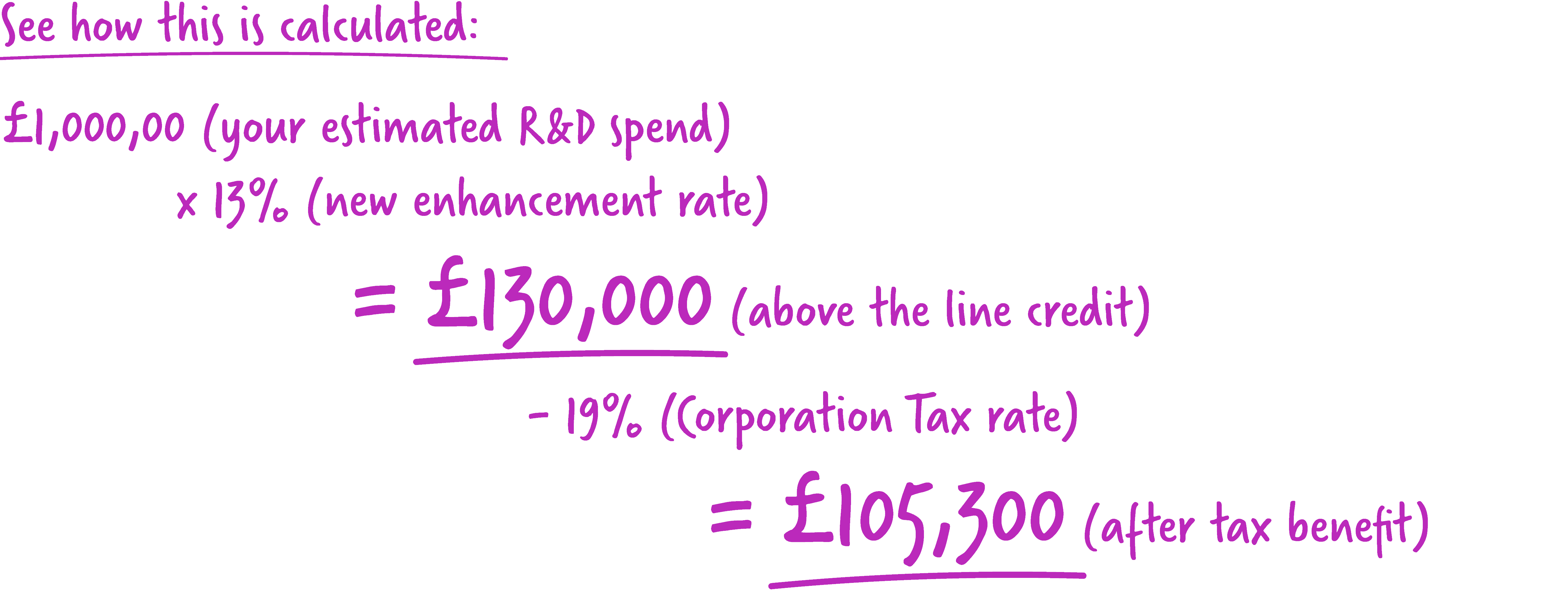

RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime. Copious Limited Floor 2 9 Portland Street Manchester M1 3BE. RD Tax Credits Whether youre new to RD.

Find Out If You Qualify For The RD Tax Credit. Get an estimate on how much your RD claim could. The Research and Development Expenditure Credit rate changed.

If you qualify you can file an RD. Most companies in the UK that claim RD tax relief fit into the SME category. Total RD enhanced deduction is 104000.

How much have you invested in RD over the last year. RD Tax Credit Calculator. How to calculate the RD tax credit using the traditional method.

R D Tax Credit Calculation Examples Mpa

How Is R D Tax Relief Calculated Guides Gateley

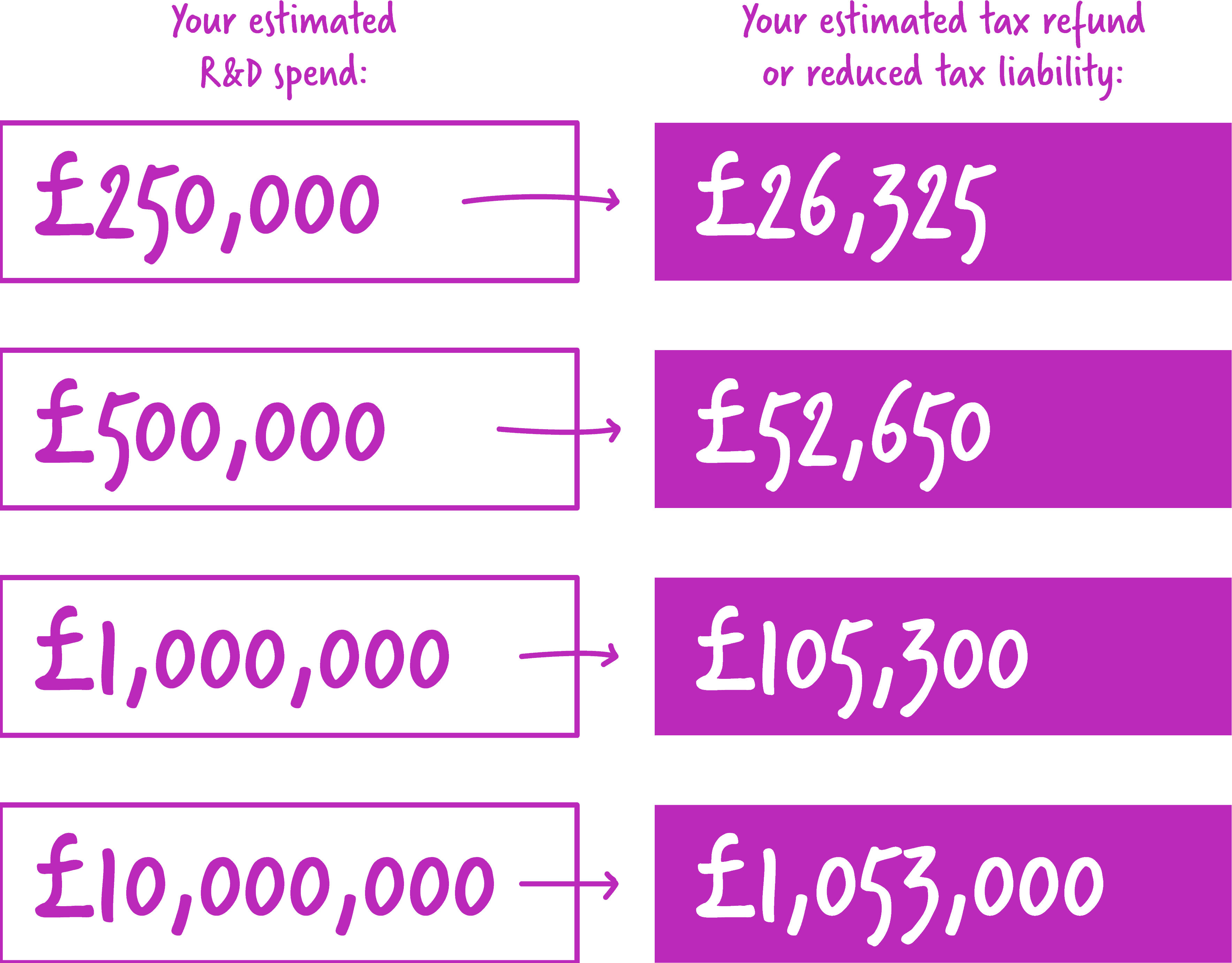

Rdec Scheme R D Expenditure Credit Explained

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

How To Claim Hmrc Research Development R D Tax Credits Easily

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

Sa302 Tax Calculation Request Form Tax Self Assessment Request

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Tax Payment Concept State Government Taxation Calculation Of Tax Return Man Fills The Tax Form Documents Calendar Calculat Irs Taxes Tax Debt Tax Payment

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

Research Insights Business Trends Getapp Resources Small Business Infographic Cloud Computing Clouds

Accounts Payable Cycle Definition 12 Steps Of Accounts Payable Cycle Accounts Payable Accounting Accounting Basics